November Insights

"You make most of your money in a bear market, you just don’t realize it at the time."

SHELBY CULLOM DAVIS

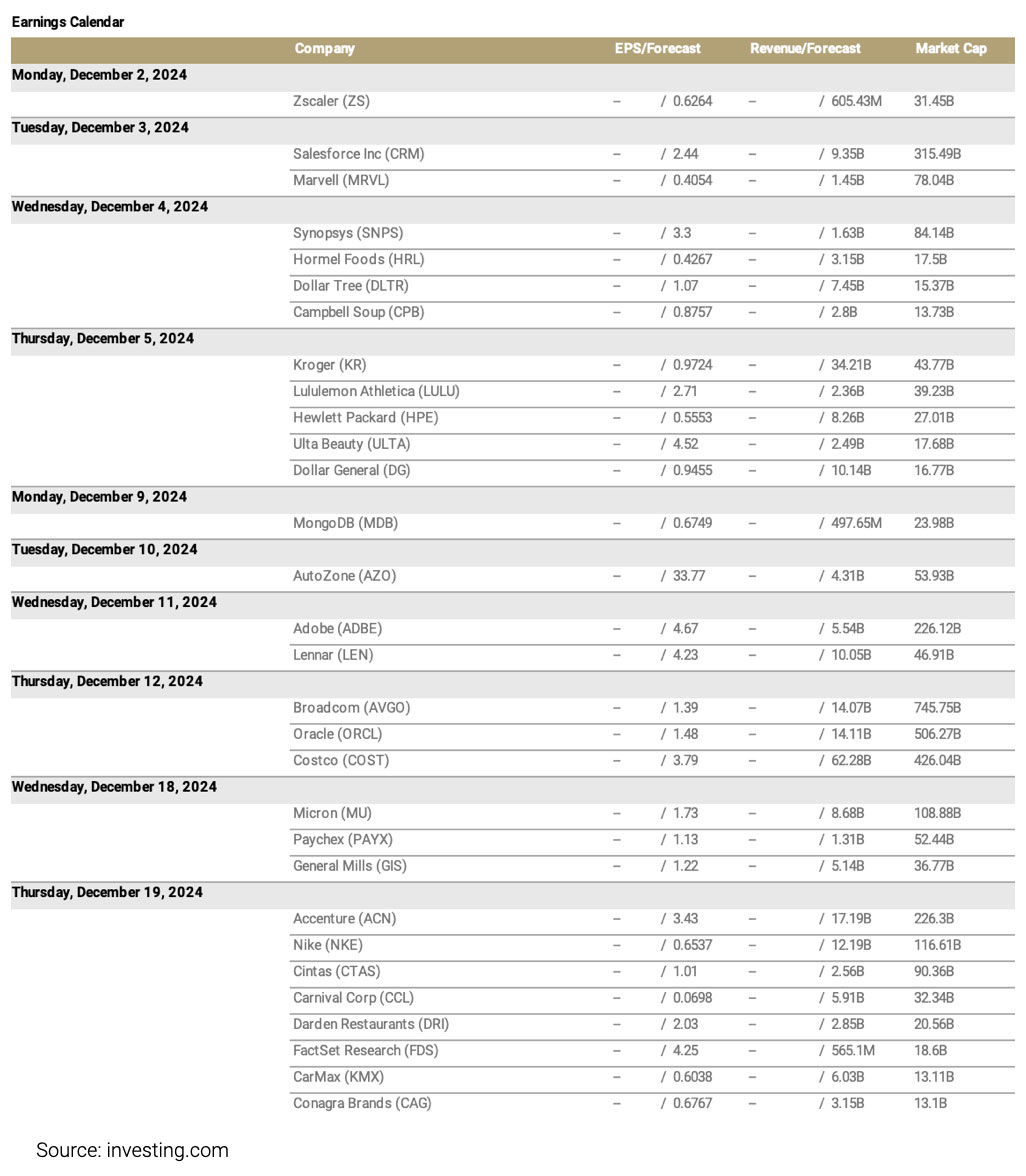

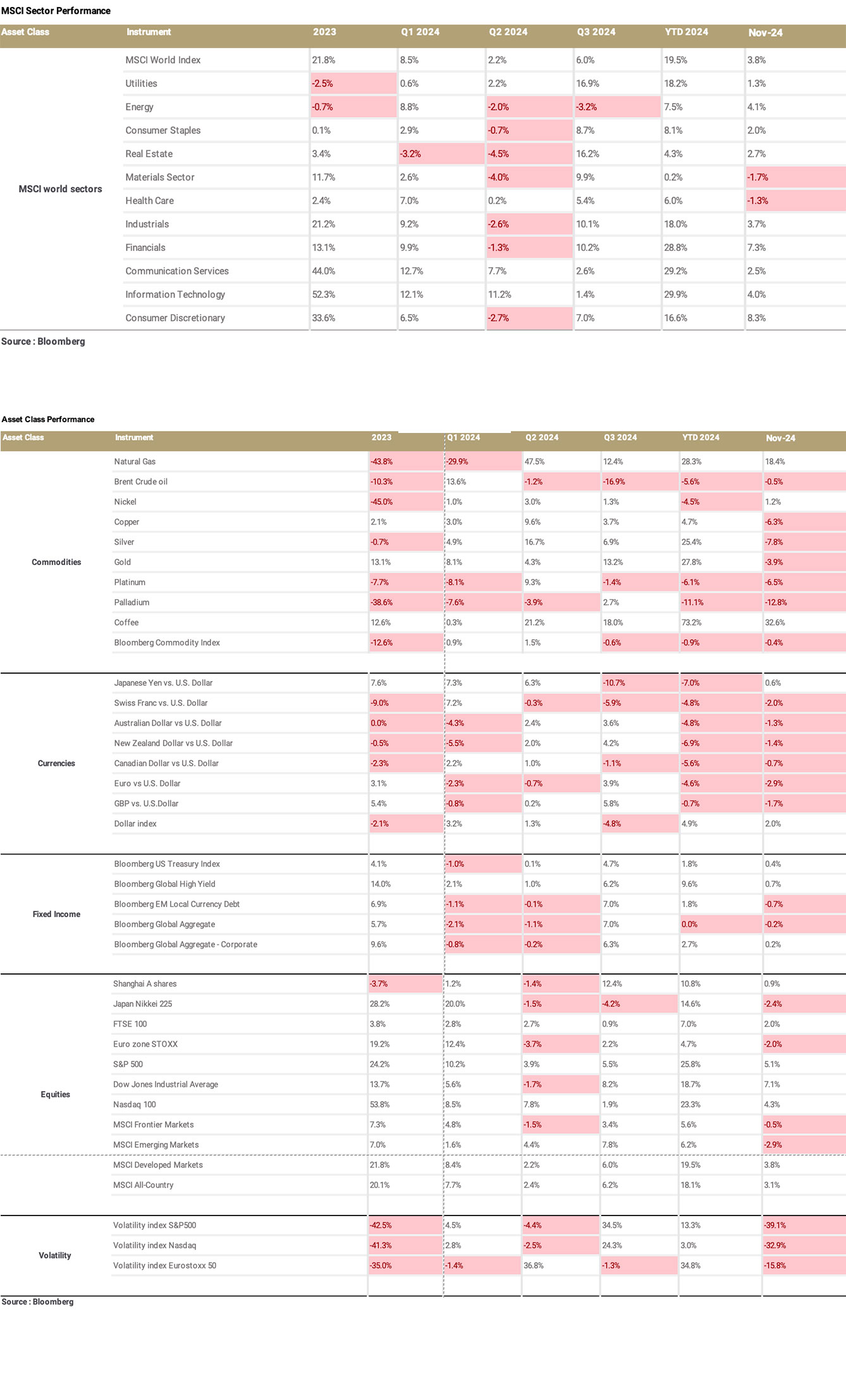

Unlike October, which experienced heightened volatility in equity markets, November saw a significant reduction in volatility, driven by greater market certainty following the US Presidential election results. The S&P 500 rose by 5.1%, the Dow Jones gained 7.1%, and the Nasdaq climbed 4.3%. In international markets, the FTSE 100 increased by 2.0%, while Japan’s Nikkei 225 and the Euro Stoxx 50 both experienced declines of 2.4% and 2.0%, respectively.

Source: Bloomberg, Fiducia Capital Limited

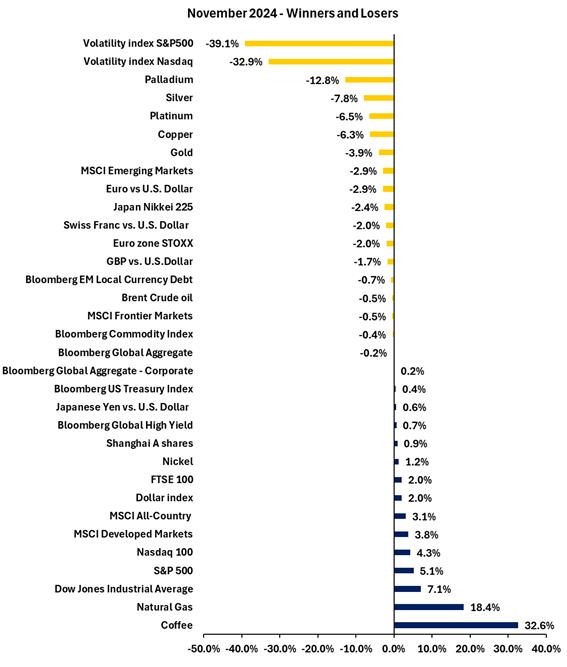

After a lengthy political campaign season, the United States reached a decisive outcome in the 2024 election, with former President Donald Trump emerging victorious. He is set to be sworn in as the 47th president on Inauguration Day, January 20, 2025. The election resulted in a Republican sweep of the Presidency, Senate, and House, positioning President-elect Trump to advance his ambitious policy agenda. The market's immediate reaction, particularly in the stock market, was overwhelmingly positive. Republicans have outlined a pro-growth policy framework, including plans to extend the Tax Cuts and Jobs Act (TCJA), further reduce corporate tax rates, and ease regulations on industries such as financial services.

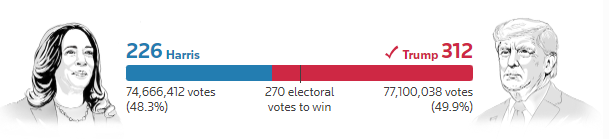

A key element of President Trump's economic agenda is the extension of the 2017 individual tax cuts, which are set to expire at the end of 2025. Additionally, a Republican administration may seek to reduce corporate tax rates from 21% to 15%. Lower taxes, coupled with deregulation efforts, could spur economic growth, and increase corporate profits. This potential boost comes at a time when the economy is already expanding at a robust pace. However, as with most fiscal measures, there are trade-offs. Extending the tax cuts alone is projected to add nearly $5 trillion to the deficit through 2034, further inflating government debt. Combined with tariffs and an aggressive stance on immigration, these policies could lead to higher inflation and interest rates. Reflecting these concerns, as well as the possibility of stronger economic growth, government bond yields have been rising since mid-September, when the Federal Reserve began cutting interest rates. With the national debt at record levels and high interest rates driving up the cost of government borrowing, some Republican lawmakers may become more cautious about supporting tax cuts that could exacerbate the deficit. Even within his own party, Trump could face resistance if concerns over fiscal sustainability intensify. In the US, the treasury has $7 trillion of debt to refinance in 2025. With the administration running huge budget deficits, in order to avoid problems at the long-end of the yield curve Secretary Yellen decided to refinancing.

skew the issuance heavily towards T-Bills. However, T-Bills mature quickly, and together with older bonds, they contribute to a massive $7 trillion maturity wall for the U.S. government. Adding to this challenge, U.S. banks are constrained by regulatory requirements and have limited balance sheet capacity to absorb more issuance. Refinancing at higher yields only exacerbates the deficit through increased net interest payments, which are already nearing $1 trillion annually. This situation is likely to intensify pressure on the Federal Reserve from President-elect Trump to lower interest rates next year, ensuring smoother For instance, in 2000, it took 12 months for the Fed's tightening to push the economy into recession the following year, while in 2008, it took over two years. Understanding that macroeconomic lags are long, and variable is crucial. This time, the lag may be even longer, as U.S. corporations and households have strategically extended their debt at low rates, resulting in limited refinancing needs and a small share of floating-rate debt. Additionally, pro-cyclical fiscal stimulus is helping the economy maintain momentum.

Source: Bloomberg, US Treasury

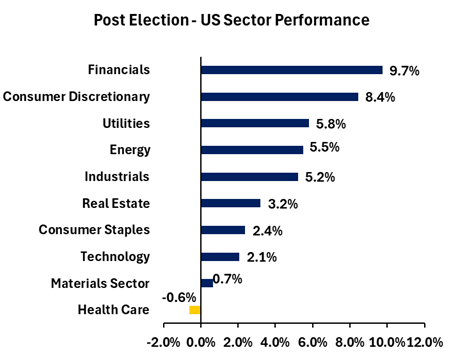

Since Election Day, stock markets have generally moved higher, with cyclical sectors—those that benefit from economic growth—seeing the most significant gains. The financials sector has emerged as a clear winner, as it is expected to thrive under the Trump administration's likely push for lighter regulations. We favor regional banks over large financial institutions, anticipating greater upside potential in the regional banking sector. Vice President-elect J.D. Vance had previously raised concerns about a regulatory proposal that would require regional banks to hold higher capital buffers against future losses. The onset of the easing cycle, after two years of tightening, offers significant relief for U.S. midsize banks. Policies focused on boosting local manufacturing, energy production, and infrastructure are expected to drive increased demand for business loans, particularly benefiting small and medium-sized companies served by regional banks.

Source: Bloomberg, Fiducia Capital Limited

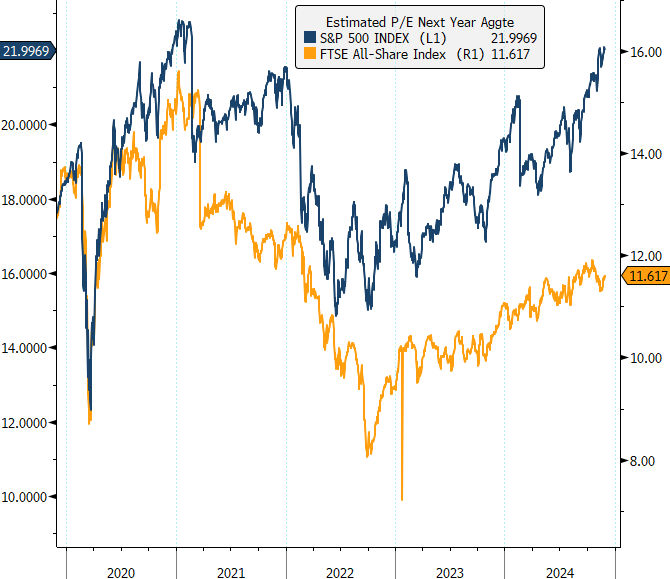

While the U.S. election has certainly influenced markets and sentiment in the short term, it's important to remember that over the long term, markets are generally driven more by fundamentals than by political events. Key drivers include innovation, productivity, and sustained economic and earnings growth. It’s also worth noting that in 2016, Trump's victory came as a surprise, and the positive market reaction was equally unexpected, especially considering that investor positioning in the lead-up to the election was aligned with a disinflationary environment, with 10-year Treasury yields below 2%. This left ample room for market repricing. Currently, however, Trump’s victory and the positive market response are widely anticipated, with many investors already positioned in equities. At a forward P/E ratio of 22x, the U.S. stock market appears expensive. The gap between dividend yields and bond yields also doesn’t support a significant equity rally. From a short-term perspective, this recent surge in U.S. equities presents an opportunity to take profits on overvalued sectors. Additionally, as the year draws to a close, it’s common for investment managers to realize gains in order to close their books on a positive note.

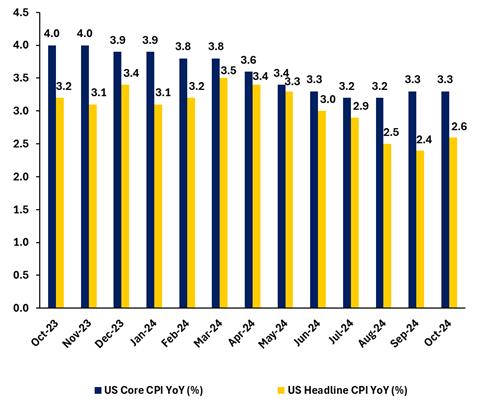

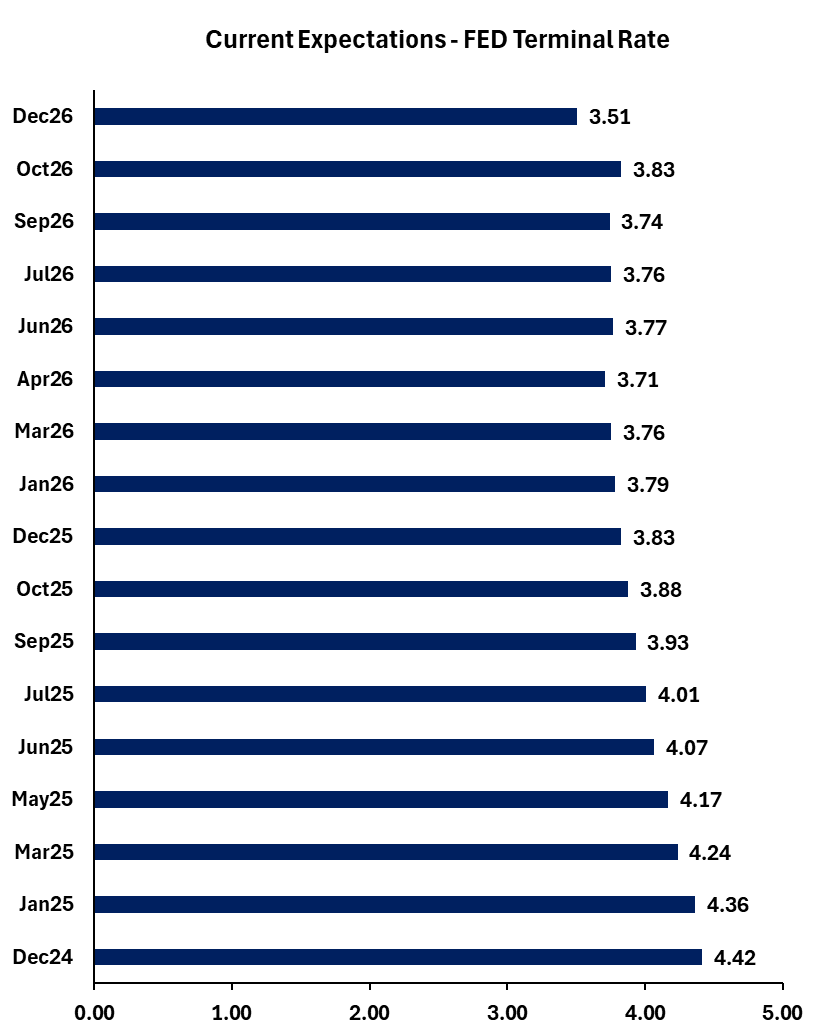

In the U.S., nonfarm payrolls increased by 12,000 jobs in October, a result impacted by strikes and hurricanes, while the unemployment rate remained steady at 4.1%. On the inflation front, headline CPI rose by 0.3% month-over-month, with an annual increase of 2.6%. Core CPI also climbed 0.3% month-over-month, with a year-over-year rise of 3.3%, all in line with expectations. Core PCE (excluding food and energy) increased by 2.8% year-over-year, also matching market expectations. PCE inflation has followed a similar disinflationary trajectory as headline CPI, dropping from a peak of 7.2% in mid-2022 to near the Federal Reserve’s 2% target. However, the disinflationary path in both the PCE measure and headline CPI looks to be decelerating in recent prints as core services prices remain persistently high. The minutes from the November FOMC meeting, released earlier this month, indicated that policymakers favored a gradual reduction in policy rates. Recent data from the U.S. economy seems to support this view. The Federal Reserve cut interest rates by 25bps earlier this month, as expected, and is anticipated to make another 25bps cut at the next FOMC meeting on December 18, 2024.

Source: Bloomberg, Fiducia Capital Limited

Equity Markets

U.S. equities continued their upward momentum in November, but we remain cautious about the outlook and believe the market may face a potential pullback in the near term. In the first week of November, the post-election certainty following President-elect Donald Trump’s decisive victory provided an initial boost to equities. However, this stability has led to investor complacency, with looming risks such as tariffs, immigration policies, higher yields, and a cautious Federal Reserve weighing on market sentiment. The rise in the 10-year Treasury yield could put additional pressure on already stretched valuations, potentially deepening any pullback. Amid this volatility, we recommend increasing exposure to defensive sectors like healthcare and consumer staples while reducing exposure to growth sectors such as information technology and communication services.

In the U.S., valuations are currently elevated relative to historical levels, largely due to the dominance of mega-cap technology stocks. The forward P/E ratio for U.S. large-cap stocks is nearly 22, which is 30% above its long-term historical average, suggesting that investors should temper their expectations. Over the past two calendar years, 2023 and 2024, valuations have expanded by more than 10%, contributing to strong market returns. However, replicating this level of growth in 2025 could be challenging. The only time in the past 30 years that we've seen three consecutive years of significant valuation expansion was in the late 1990s, leading up to the tech bubble.

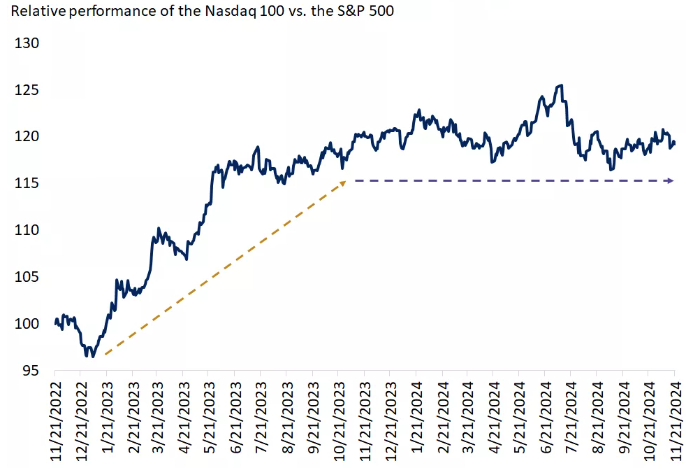

On the earnings front, all eyes were on Nvidia this month as the world's most valuable company, with a market capitalization of $3.6 trillion, reported its quarterly results. As in previous quarters, the company saw strong demand, with sales nearly doubling from a year ago and exceeding estimates by 6%. However, the company's fourth-quarter guidance was underwhelming, projecting a slowdown in revenue growth to around 70%. While this growth rate would be impressive for most companies, the mild investor disappointment highlights the high expectations surrounding Nvidia and the increasing difficulty of meeting them. AI growth remains robust, with continued spending as more companies adopt generative models to drive productivity—a trend likely to span several years. However, the tech sector appears to be in a phase of consolidation, digesting the outsized gains of the past two years, and is no longer the dominant leader it once was. Relative to the S&P 500, the tech-heavy Nasdaq 100 peaked in July and has since moved sideways. Meanwhile, other sectors such as financials and industrials have stepped up, taking the lead in driving market performance.

Source: FactSet, Edward Jones

The good news for investors is that, despite elevated valuations relative to historical averages, much of this is driven by the dominance of mega-cap technology stocks, and not reflective of the broader market. The equal-weighted S&P 500, which gives the same weight to all stocks in the index and offers a better representation of the "average" stock, trades only slightly above its 10-year average P/E ratio. Meanwhile, mid-cap, small-cap, and international stocks (such as UK stocks) are trading at or below their long-term valuation averages. With a solid fundamental backdrop in place, we continue to see attractive long-term opportunities in areas that have been overlooked since the bull market began two years ago.

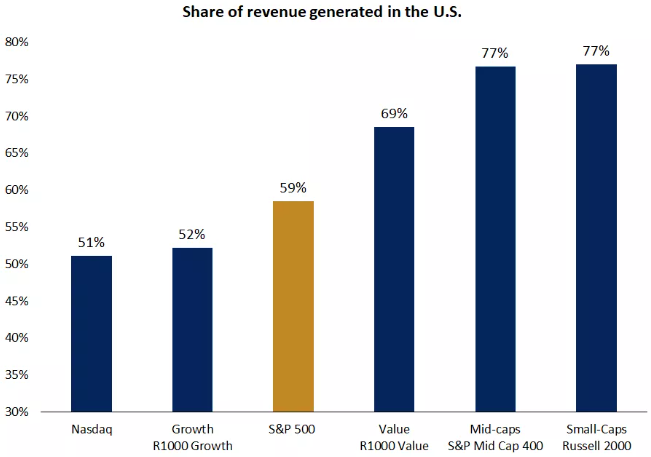

In the U.S., companies with primarily domestic operations are likely to benefit more from a Trump victory, given his strong protectionist stance. In the coming year, the focus will likely shift to the health of the economy, trade tariffs, and taxes. The expected extension of tax cuts, combined with a more relaxed regulatory approach, should provide a boost to U.S. economic growth. With expectations of a strong economy, decreasing inflation, and the Federal Reserve set to cut rates again, small-cap stocks—hit hard by higher rates in recent years—stand to benefit. Small- and mid-cap companies, which generate a larger proportion of their revenue from the U.S., could be key beneficiaries of stronger domestic growth and lower taxes. These sectors also offer cheaper valuations and are expected to see earnings accelerate after a two-year lull. On the other hand, larger multinationals, including mega-cap tech stocks with significant exposure to China, may be more sensitive to trade developments.

Source: FactSet, Edward Jones

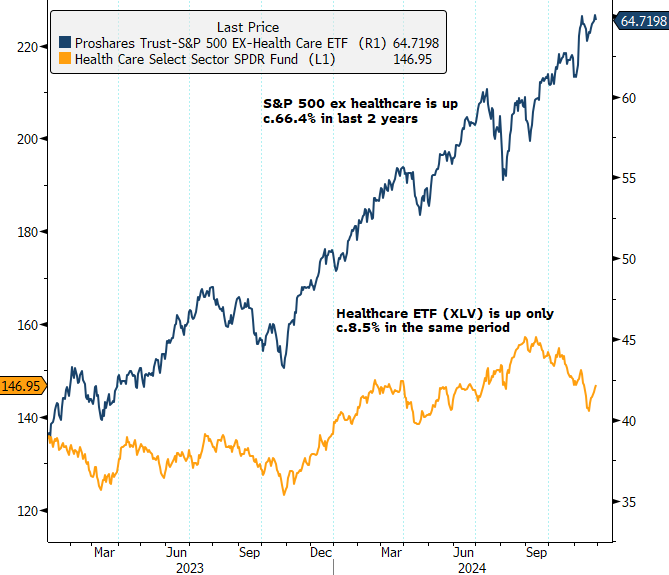

Energy is widely viewed as a favourable sector under a Trump administration, though there are longer-term considerations. While energy stock valuations are currently attractive, the supply and demand dynamics may become more complex as production increases. Despite this, we believe the risk-reward still favours upside in the sector, particularly for downstream companies involved in refining, marketing, and distribution. Additionally, Trump's victory is a net positive for aerospace and defense stocks, as U.S. defense spending and support for American defense exports are expected to rise under his administration. Interestingly, the U.S. healthcare sector has significantly lagged the broader market over the past two years. The industry is heavily supported by the government and benefits from favourable demographic trends. Investors also appreciate that healthcare tends to provide steady performance. However, healthcare stocks have underperformed the market by nearly seven to one in the last two years, largely due to an unfriendly administration in Washington and the broader aversion to defensive stocks on Wall Street.

Source: Bloomberg, Fiducia Capital Limited

In other markets, we continue to favor UK stocks. Throughout 2024, the S&P 500 has significantly outperformed the UK’s FTSE All-Share index, resulting in the UK equity market trading at nearly a 50% discount to the U.S. benchmark. There is a stark contrast between expectations for U.S. companies and their UK counterparts. S&P 500 earnings are projected to grow by 14% over the next 12 months, with the index trading at a multiple of 22x those earnings. In contrast, FTSE All-Share earnings are expected to grow by 8%, with the index trading at just 11x earnings. This suggests that much of the UK’s underperformance is already priced in.

UK companies are also known for paying attractive dividends, with the FTSE All-Share offering a 4% yield compared to just 1% from the S&P 500. Additionally, buybacks have picked up in the UK, signalling that the CFOs of UK-listed companies consider their shares undervalued. UK buyback yields now surpass those in the U.S., with the FTSE All-Share offering a current cash yield of nearly 6%. Moreover, merger and acquisition activity are on the rise, which should further support valuations.

Source: Bloomberg, Fiducia Capital Limited

Fixed Income Markets

While the stock market has moved higher, the bond market has notably declined in the runup to the US elections. This shift reflects not only the growth-oriented policies but also new risks to the broader economy. First, there is a significant risk of further increases to the U.S. deficit, which is already near historic highs at nearly 120% of federal debt to GDP. For instance, cutting taxes could reduce government revenues, making it harder to fund or pay down U.S. debt and placing additional pressure on deficit spending. Second, there is a risk of reigniting inflationary pressures, particularly with potentially higher growth and tariffs. Some of these costs may be Passed on to consumers as higher prices. According to a post by Trump on the social media platform Truth Social, he plans to raise tariffs by an additional 10% on all Chinese goods entering the U.S. and impose a 25% tariff on all products from Mexico and Canada.

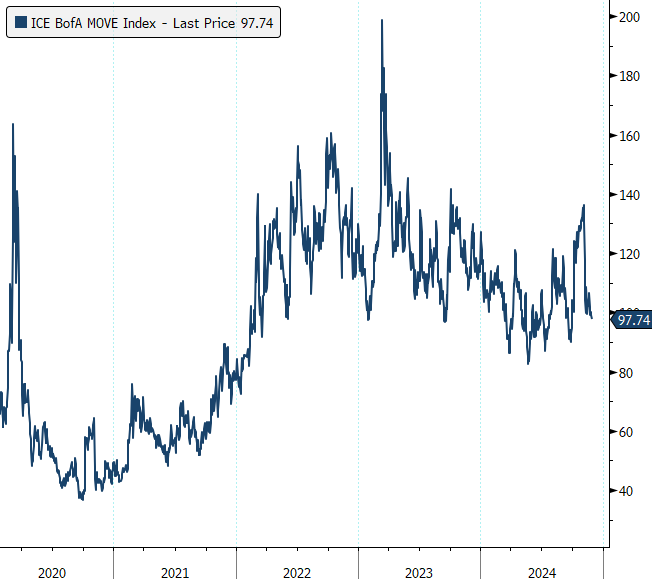

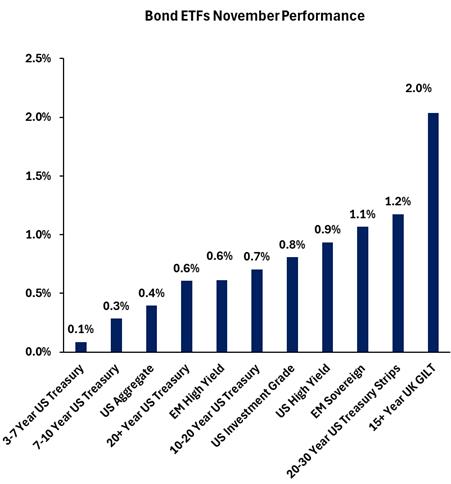

Global bond markets posted muted returns in November, as U.S. Treasury yields remained largely flat for the month. Short-term yields rose, with the U.S. 2-year Treasury yield increasing by 1.4%, while longer-term yields declined, with the U.S. 10-year and 30-year yields falling by 0.5% and 0.8%, respectively. The Bloomberg U.S. Treasury Index gained 0.4% last month, while the Bloomberg Global Aggregate Index rose by 0.2%. The Bloomberg Global High Yield Index also saw an increase of 0.7% in November. The MOVE Index, which tracks bond market volatility, reached a one-year high in October but retraced sharply, falling by approximately 28% in November.

Sources: Bloomberg, Fiducia Capital Limited

Sources: Bloomberg, Fiducia Capital Limited

If the new administration's primary focus is on boosting growth, there is significant potential for positive outcomes in the U.S., with possible spillover effects globally. However, this would likely require shifting attention away from campaign promises such as the deportation of undocumented immigrants and tariffs. The main downside risks would emerge if greater emphasis is placed on aggressive trade and immigration policies, which could negatively impact growth and contribute to rising inflation. This could prompt the Federal Reserve to halt or slow its rate-cutting cycle. Markets are now anticipating the Fed will lower its policy rate from the current 4.75% to around 3.83% next year, which is higher than earlier expectations (September 2024) for a rate cut to approximately 3.5% levels.

Source: Bloomberg, Fiducia Capital Limited

Despite moderating inflation and supportive monetary policy, the outlook for 2025 faces significant geopolitical challenges. U.S.-China tech competition, the ongoing conflict in Ukraine, and rising tensions in the Middle East create an interconnected risk environment. In the event of a recession in the U.S. and other global economies, we would expect bonds to once again serve as a hedge against equity losses.Bonds have already shown their value in times of recessionary fears. For example, during the equity of 3.2%.market sell-off in the summer of 2024, bonds displayed their typical offsetting characteristics: U.S. equities dropped by 8.4% from July 16 to August 5, while U.S. 10-year Treasuries posted positive returns.

During his previous term, President Trump frequently criticized the Federal Reserve for being slow to cut rates and has promised to lower interest rates if re-elected. While the U.S. Federal Reserve operates independently, it’s likely that Trump will attempt to influence its policy decisions. In the current environment of low inflation, we continue to favor duration and recommend increasing exposure to longer-dated bonds rather than reducing it. We see the rally in bond yields as an opportunity to add to duration and lock in higher yields. Following the Fed's November rate cut, yields on quality investment-grade bonds have risen above cash rates, suggesting that investors may want to consider repositioning from cash and cash-equivalents into intermediate and long-term bonds.

FX Markets

As expected, the U.S. dollar was well-supported in Q4, driven by elevated U.S. Treasury yields, stronger-than-expected economic data, and ongoing global uncertainties. The post-election reaction was also positive, as a strong USD is often associated with the ‘Trump trade.’ The Dollar Index (DXY), which measures the U.S. dollar against six major currencies, rose by 2.0% in November, while the Euro, British Pound, and Swiss Franc fell by 2.9%, 1.7%, and 2.0%, respectively, against the U.S. dollar. Looking ahead to 2025, we believe market performance will be influenced by the direction of yields, economic momentum, and risk sentiment, all of which will shape currency movements. In the U.S., much will depend on how the Federal Reserve navigates fiscal changes under a new presidency. Tax cuts may lead to higher debt, and concerns about potential inflation could limit the Fed's ability to cut rates further. While we expect the Fed to continue its rate-cut path for now, we anticipate the U.S. dollar will remain well-supported in the near term.

The Euro has weakened notably, likely due to concerns over higher tariffs and uncertainty surrounding Trump’s stance on Ukraine and NATO. A potential U.S. disengagement from the Ukraine conflict could create a funding gap that Europe may need to address.

Additionally, trade uncertainties are weighing on the already stagnating Eurozone economy, raising the risk of larger rate cuts by the European Central Bank. The UK, on the other hand, is less exposed to direct tariff risks than the Eurozone, given its trade deficit in goods with the U.S. The recent fiscal expansion announced in the UK should support the economy, suggesting a more gradual approach to easing monetary policy, which is likely to benefit the British pound.

Among the low-yielding currencies, we prefer the Swiss franc over the Japanese yen as the funding currency of choice. While Swiss exporters face rising pressure from trade uncertainties and the country experiences pronounced disinflation, there are concerns that the Swiss National Bank (SNB) may ease further. This raises the possibility of negative Swiss interest rates returning, which could create additional risks for the CHF.

Commodities Markets

The Bloomberg Commodities Index fell by 0.4% in November. Despite a strong year-to-date performance, gold experienced a negative post-election reaction, pressured by a stronger USD and higher U.S. yields, dropping 3.9% in November. While we maintain a bullish long-term outlook for gold, current levels appear stretched, and we see some downside risks in the near term. Nevertheless, gold remains a reliable portfolio stabilizer and a safe-haven asset. Central banks added over 1,000 tons to reserves in both 2022 and 2023, driven by concerns over the "weaponization" of the global financial system, such as the freezing of Russian foreign reserves. Investment in gold continues to grow, as it serves as an effective hedge against geopolitical instability and currency debasement, making it especially relevant in the current climate.

Source: Bloomberg, Fiducia Capital Limited

The U.S. presidential elections have had a limited impact on oil prices so far, as it remains uncertain which of Trump’s policies—potentially impactful to oil markets—will prevail in the near term. A return to a maximum pressure strategy on Iran, including tougher enforcement of sanctions on Iranian oil, could pose an upside risk to oil prices. Conversely, a shift towards a broader tariff agenda under the Trump administration could dampen global demand, which may put downward pressure on oil prices. OPEC+ has delayed unwinding its December production cuts by another month. We continue to see a risk in OPEC+ not following through on its pledge to unwind its full cut to avoid weakening oil prices excessively.

Asset Class Performance

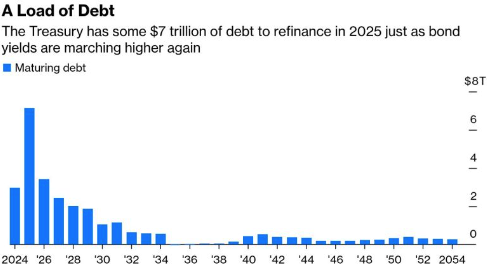

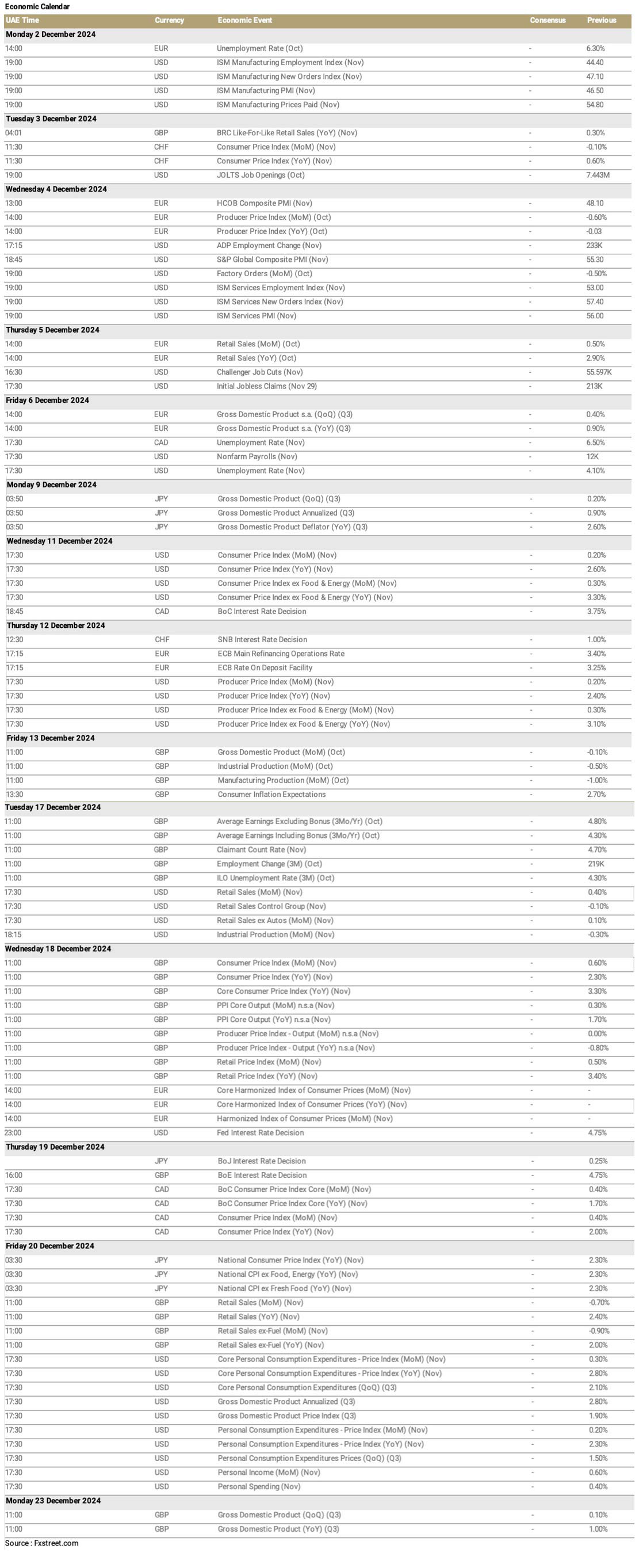

Economic Calendar

Earnings Calendar